Investing in real estate can be a fantastic opportunity, especially when it comes to leased land. You might be wondering, what exactly is leased land? Simply put, it’s a piece of land that you rent from someone else, usually for a long time anywhere from 25 to 99 years.

During this time, you can build and profit from any properties on that land. Let me share why investing in leased land could be one of your best decisions.

Understanding Leased Land

First off, let's talk about what a land lease means for you. When you sign a lease, you are securing the right to use that land.

This agreement gives you the security of ownership for a specific period. It’s essential to know the lease duration and the possibility of renewing it.

This flexibility allows you to plan for the long term!

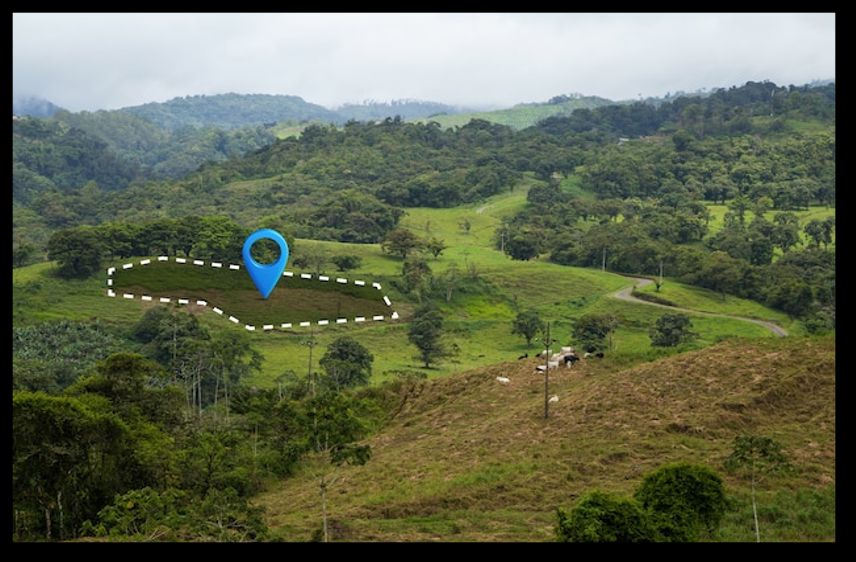

Geographical and Strategic Location

One of the biggest advantages of leased land is its geographical location. Many leased lands are found in prime areas, like bustling cities.

Imagine investing in a place where demand is high! These strategic locations mean that your investment is more likely to appreciate in value.

The better the location, the more potential there is for a significant return on investment (ROI).

Government Regulations and Support

When you invest in leased land, you’re often supported by government regulations. In major cities like Nairobi or Mombasa, the government provides essential services like water, electricity, schools, and shopping centers.

This means that you won’t have to worry about building infrastructure from scratch, which can be a huge relief.

Freedom to Use Leased Land

What I love about leased land is the freedom to use it. Once you sign that lease agreement, the land is yours to use for various purposes.

You could build commercial properties or rental apartments and start earning income right away! This ability to create a profitable venture is a major perk of leasing land.

Financial Advantages

Another great point is access to willing financiers. If you develop a commercial property on leased land, financial institutions are often eager to help you fund your project.

Why? Because they see it as an appreciating asset. When you present a well-located property, banks may come knocking at your door with offers.

Long-term Investment Strategy

Investing in leased land can be a brilliant long-term investment strategy. Many people renew their leases for generations because they recognize the value.

This could be your chance to secure a piece of land that not only brings you income but also has the potential to grow in value over time.