Did you know you can invest in a property that has not even been built yet? Just blueprints on paper, 3D visuals on a screen, and a lot of promise. Is it risky? Yes. Is it also rewarding? Absolutely.

A bit like ordering a meal you have never tasted before? That is exactly what investing in off-plan property feels like. It is a gamble, but a smart one when you know what to watch out for.

If you are eyeing a more affordable way into the real estate market, or want to profit before a building even exists then off-plan could be your golden ticket. But like any good gamble, it comes with risks and rewards.

Let’s break down how you can invest in off-plan property with confidence.

What Is Off-Plan Property?

Off-plan property means buying a home before it's completed and sometimes before construction even begins. Developers often offer properties at lower prices during the early stages to fund the construction.

In exchange, buyers hope the value will rise by the time it's ready. It’s a strategy for getting ahead of the curve in rising markets.

Why Invest in Off-Plan Property?

Lower Entry Prices

The early bird buyers usually pay less than the final market price.

Flexible Payment Plans

You don’t need the full amount upfront. Many developers offer the chance to pay bit by bit while the home is being built.

Customization Options

Buyers can often choose layout options, interior finishes, or upgrades.

Capital Growth Potential

In emerging property hotspots, your investment could appreciate even before you receive the keys.

Risks You Must Consider

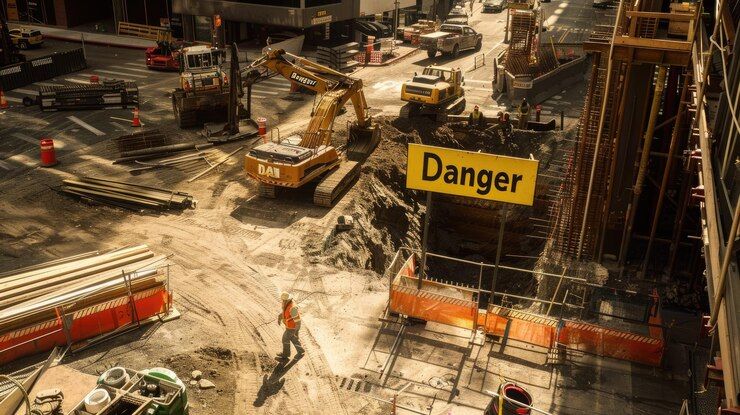

Construction Delays

Timelines can shift due to permits, labor, or financing. Prepare for delays.

Market Fluctuations

Real estate markets aren’t immune to downturns. You could end up overpaying if values drop.

Developer Risk

Not all builders deliver on time, or at all. Research their track record before committing.

Legal Complications

Off-plan contracts can be complex. Always have a qualified real estate lawyer review everything.

How to Be a Smart Off-Plan Investor

To make a smart off-plan property investment;

Start by thoroughly researching developers. Check their track record, past projects, and customer reviews to ensure you are dealing with a reputable builder.

Don’t sign anything blindly. Instead, have a qualified lawyer review the contract so you fully understand the terms and your rights.

If possible, visit the construction site regularly to monitor progress and address any issues early.

Always set aside a financial cushion to cover unexpected costs or project delays, which are common in off-plan deals.

Lastly, study market trends and the surrounding area's development plans. Are there upcoming schools, roads, and shopping centers that can significantly impact future property value and rental demand.