If you're a homeowner or planning to buy a house, understanding mortgage default is crucial. Simply put, mortgage default happens when you miss one or more of your home loan payments. If ignored for too long, this could lead to serious consequences like foreclosure or property seizure.

But don’t panic there’s a way to avoid these issues. In this guide, I’ll show you what happens when you default on a mortgage, how you can prevent it, and the steps you should take if you ever find yourself in this situation.

What Happens When You Default on Your Mortgage?

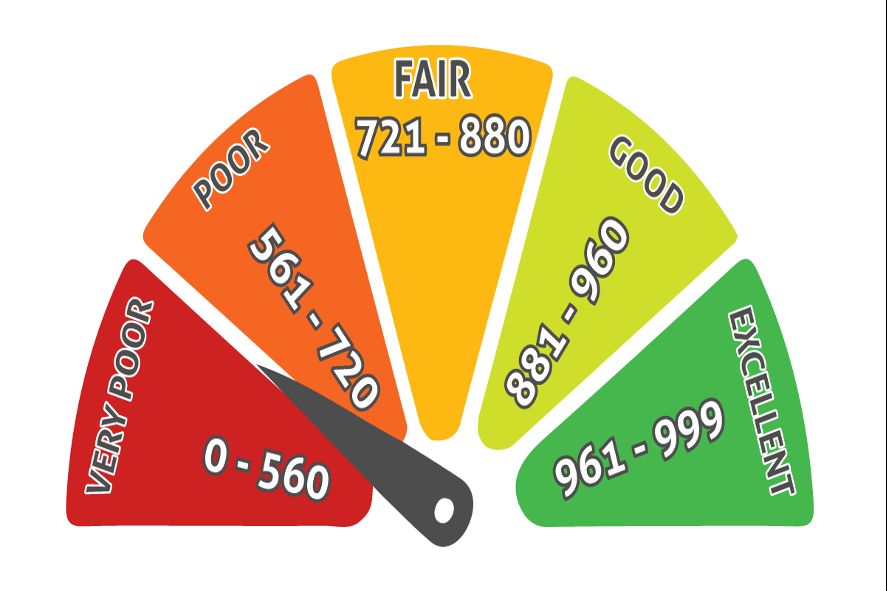

The consequences of defaulting on a mortgage can be severe. Missed mortgage payments can quickly add up, leading to a poor credit score and even the dreaded foreclosure process. When this happens, your lender may take legal action to repossess the property and sell it to recover the outstanding loan balance.

In the worst-case scenario, your home could be taken away, and you might lose your investment. But the good news is, there are ways to prevent this from happening.

Foreclosure Process: What You Need to Know

If you miss payments for a few months, your lender might start foreclosure proceedings. Foreclosure is a legal process where the lender takes back the property to sell it and recover the remaining loan balance.

Foreclosure prevention is possible if you take action early. It usually begins after you’ve missed 120 days of payments, and once it starts, it can be difficult to stop. However, options like loan modification or refinancing might help you avoid foreclosure altogether.

If you’re facing foreclosure, working with a foreclosure attorney could help you understand your legal rights and prevent the worst-case scenario.

How to Avoid Defaulting on Your Mortgage: Tips for Success

Preventing mortgage default is possible with careful planning. Here are a few strategies to protect your home:

Loan Modification: Talk to your lender about changing the terms of your loan. This could include lowering your interest rate or extending the term of your loan to make your payments more manageable.

Loan Payment Extension: If you’ve experienced a temporary financial setback, your lender might offer a payment extension to give you more time to catch up on missed payments.

Mortgage Refinancing: If your current interest rate is too high, refinancing could lower your payments and prevent mortgage default from escalating into foreclosure.

Pay Off Mortgage Arrears: If you’ve missed a few payments, it’s best to catch up on your mortgage arrears quickly. The sooner you settle the overdue balance, the less likely you are to face foreclosure.

By taking action early, you can prevent defaulting on your mortgage and avoid the pain of losing your home.

Why Communication with Your Lender is Key

If you’re struggling with mortgage payments, communication with your lender is critical. Most lenders are willing to work with homeowners who show a genuine effort to resolve the situation. Discuss your financial issues, and they might offer you options like a mortgage loan modification or other payment solutions.

Ignoring the problem will only make it worse. So, if you're having trouble, reach out to your lender as soon as possible to discuss how you can avoid defaulting on your mortgage.

Can an Attorney Help Prevent Foreclosure?

If you’ve already missed several payments and defaulted on your mortgage, a foreclosure attorney can help. They can advise you on the best foreclosure defense strategies and even negotiate with your lender to stop the foreclosure process.

A lawyer can also help you understand property seizure laws and work to protect your home if you’re in danger of losing it.