Are you about to buy or sell a property? Whether you're a first-time homebuyer or an experienced investor, understanding a purchase contract is crucial. This legal document helps guide your real estate transaction by outlining the terms, conditions, and responsibilities of both the buyer and seller. In this post, I’ll explain what a purchase agreement is, how it works, and why it’s so important.

What Is a Purchase Contract?

A purchase contract (also known as a sales agreement or real estate purchase agreement) is the formal agreement between the buyer and seller in a real estate transaction. It defines the key terms, including the property address, selling price, and both parties' responsibilities. Without this signed contract, there’s no official sale, and neither party is legally bound to the deal.

Once the buyer makes an offer on a property whether residential, commercial, or industrial and the seller agrees, the contract is formed. Both parties will review and sign the purchase agreement, making it a binding legal document.

Key Components of a Purchase Contract

A purchase contract contains critical details that ensure a smooth transaction. These include:

Legal Address: The exact location of the property being sold.

Selling Price: The agreed-upon price for the property.

Buyer’s Responsibilities: The buyer must follow through with securing financing or arranging an inspection.

Seller’s Responsibilities: The seller must disclose property issues and complete any agreed-upon repairs.

Terms of Purchase: This outlines the closing date and other important terms of the sale.

Contingencies: What You Need to Know

A purchase agreement often includes contingencies—conditions that must be met for the sale to proceed. If any contingency fails, the buyer or seller can cancel the contract.

1. Loan Contingency

A loan contingency ensures the sale only proceeds if the buyer is approved for a mortgage loan. If financing falls through, the buyer can back out without penalty.

2. Inspection Contingency

This allows the buyer to inspect the property before finalizing the sale. If significant issues are found, the buyer may request repairs or cancel the deal.

3. Appraisal Contingency

If the home’s appraised value is lower than the agreed price, the buyer can renegotiate or walk away from the deal.

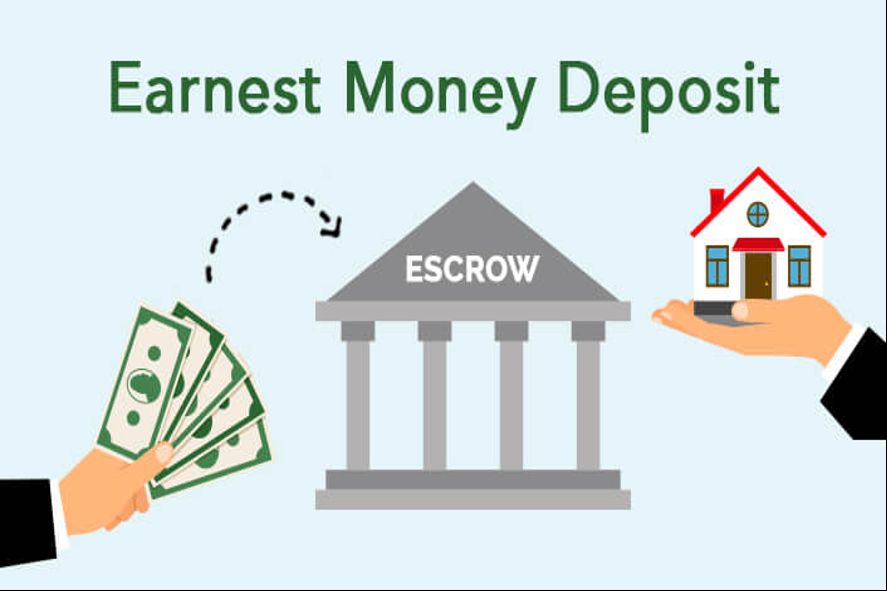

Earnest Money Deposit: Why It’s Important

An earnest money deposit is a small sum the buyer pays to show they’re serious about buying the property. This money is applied toward the purchase price if the sale goes through. If the deal falls apart due to the buyer’s fault, they may lose the earnest money.

Closing Costs: What to Expect

Both the buyer and seller are responsible for closing costs, which can include title fees, insurance fees, and other charges. It’s important to factor in these additional costs early on to avoid surprises during closing.

Can You Write Your Own Purchase Contract?

While it’s ideal to have a licensed real estate agent or attorney help draft your purchase contract, it is possible to write one yourself. Just be sure to include:

Legal Address

Selling Price

Buyer’s and Seller’s Responsibilities

Terms and Conditions

However, it’s always recommended to consult with a professional to ensure the document is legally sound.