One of my biggest dreams has always been to own a house or a piece of land. Real estate is an incredible way to invest and can bring in higher returns. It plays a major role in the economic growth of our country and creates job opportunities.

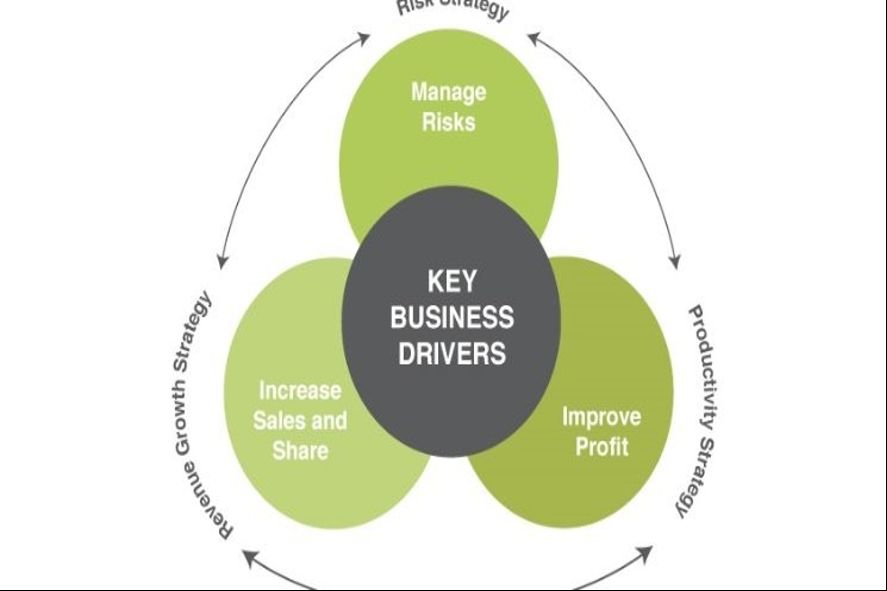

But what really drives the real estate market?

Let’s explore the key factors that can help you make smart investment choices.

1. The Role of Government in Real Estate

The government has a big impact on the real estate sector. They create laws and regulations that can help or hurt how the market works. For example, they can offer policies and subsidies to make buying a home easier.

These changes in tax laws can really influence how much demand there is for properties.

2. Demographics: Understanding Population Dynamics

Next up is demographics. This term refers to the number of people living in a certain area. If a place is crowded, like a big city, there’s a higher property demand. This means prices usually go up because more people want to live there.

Additionally, properties in prime areas are often more valuable, making them great investments.

3. Economic Factors Impacting Real Estate

The health of the economy is another important factor. We measure this using the Gross Domestic Product (GDP) and other economic indicators. When the economy is strong, people are more likely to buy homes, which helps the real estate market grow.

However, if the economy is weak, it can negatively affect real estate values and investments.

4. Interest Rates: A Critical Driver

Interest rates play a crucial role in real estate investments. When interest rates are low, it’s easier to get a mortgage. This means more people can afford to buy homes, driving up property values.

On the flip side, when interest rates rise, it can become harder to borrow money, which may decrease demand for homes.

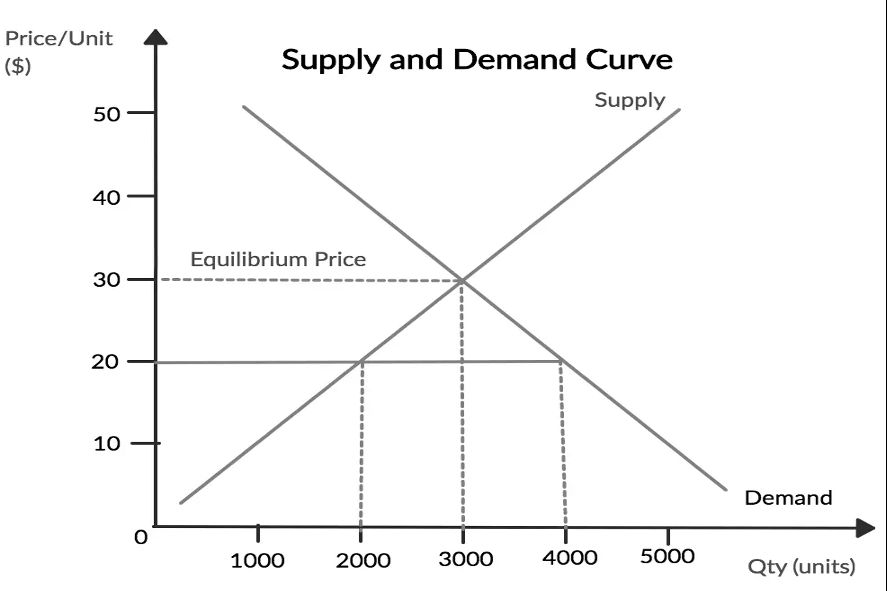

5. Demand and Supply Curve Analysis

Understanding the demand and supply curve is essential for any real estate investor. When there are fewer properties available, demand goes up, leading to higher prices. Knowing market trends will help you find the best time to invest.

Always keep your target audience in mind who you think will want to buy or rent the properties you invest in.

6. The Importance of Capital Availability

Finally, let’s talk about capital availability. Having enough funds to invest is crucial. When investors have access to money, it allows them to take advantage of great deals and develop properties.

If funds are limited, it can hurt the real estate industry. Knowing your financing options can help you succeed.