Inflation is a significant word we hear a lot, but what does it mean for you and your home? When we talk about inflation, we’re referring to when the prices of goods and services go up. This includes everything we need, like groceries and, importantly, housing.

Let’s dive into how inflation affects the housing market, so you can make smart choices whether you’re buying, renting, or investing.

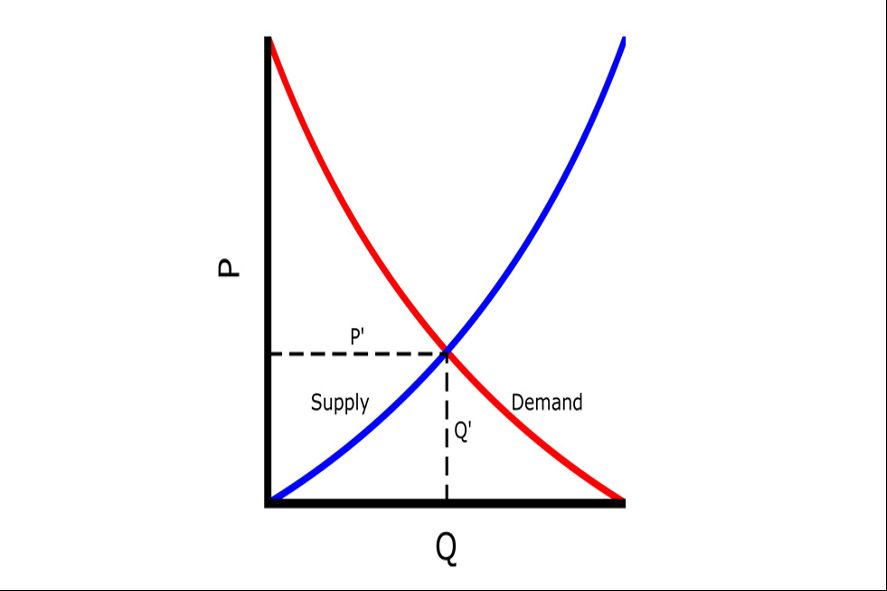

The Demand and Supply Curve in Real Estate

First, let’s understand the demand and supply curve. Imagine a seesaw. When more people want to buy homes (high demand), but the number of homes available stays the same (low supply), prices go up.

This is happening a lot right now! Knowing this can help you figure out when to buy or rent.

Challenges of Accessing Affordable Housing

With inflation, finding affordable housing is getting tougher. The costs of building materials are rising, which means builders can’t keep prices low.

As a result, many people, especially first-time buyers, find it hard to find homes within their budgets.

If you're feeling this pressure, know that you’re not alone.

Inflation vs. Housing: A Growing Concern

Over the last five years, we’ve seen home prices rise significantly. If you’re looking to buy, lease, or rent, you might feel overwhelmed by how much everything costs.

Recently, a new housing levy was introduced, which means landlords now have to pay a portion of their rental income.

This could lead to even higher rents. But don’t lose hope! Understanding these changes can help you navigate this market.

Interest Rates and Their Influence on Home Buying

Interest rates are another important piece of the puzzle. When inflation rises, governments often increase interest rates to control it.

This makes borrowing money for a mortgage more expensive. Many people find that these higher rates make it harder to get a good mortgage deal.

If you're thinking about buying a home, now is the time to keep a close eye on these rates.

The Housing Market and Future Prospects

After the COVID-19 pandemic, our housing market has been through a lot. Thankfully, things are starting to improve.

The value of our currency is getting stronger, which is great news for buyers and renters alike.

As mortgage rates begin to stabilize, it might be a perfect time for you to consider investing in real estate.

Home Buying Strategies Amid Inflation

Feeling anxious about high interest rates? Don’t worry! There are ways to make buying a home easier. One option is refinancing your mortgage if rates drop in the next few years.

The Kenya Mortgage Refinance Company (KMRC) can help you find better loan options. In addition, if you’re a first-time home buyer, there are government programs available to assist you.

Conventional and FHA loans are also great options to consider.

Inflation Beneficiaries: Who Gains?

Interestingly, homeowners, especially those with mortgages, can actually benefit from inflation. As the value of homes rises, so does your investment.

Real estate often acts as a good hedge against inflation, meaning your property can hold or even increase its value over time.