Think of your financial future as a journey. You’re standing at the start, holding a map, ready to take your first steps.

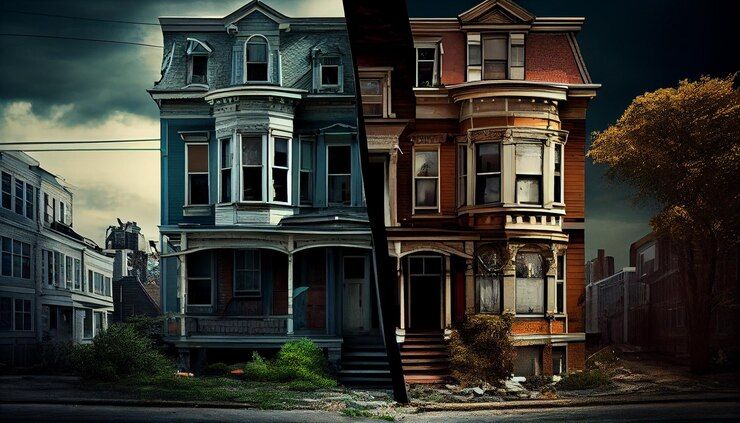

To the left, a single-family home offers a well-marked, clear, simple, and easy to follow. To the right, a multi-family unit stretches out like a winding road, with many twists and turns, offering multiple opportunities along the way.

Both routes promise the destination of financial growth, but the pace and experience of the journey will be very different. Which path will you take to reach your investment goals?

A single-family home is a property designed for one household, often with a yard and space for one family. Meanwhile, multi-family units contain multiple separate living spaces, providing rental income from more than one tenant.

The Benefits of Single-Family Homes

1. Stability and Simplicity

Single-family homes often represent a stable, straightforward investment. They typically have lower tenant turnover and require less day-to-day management. With fewer moving parts, these homes can be an attractive entry point for first-time investors.

2. Easier Financing

Banks and lenders often view single-family homes as a lower-risk investment, making them easier to finance. Whether you're financing through traditional loans or looking for other funding options, securing a loan for a single-family property is usually simpler than for larger multi-family buildings.

3. Steady Appreciation

Single-family homes in desirable areas have a strong potential for long-term appreciation. As neighbourhoods develop and improve, the value of these homes rise steadily, offering investors a solid return when it's time to sell.

4. Lower Maintenance Costs

With just one unit to manage, maintenance costs are generally lower compared to multi-family properties. If you’re looking for less complexity and fewer repairs, a single-family home might be the way to go.

The Benefits of Multi-Family Units

1. Higher Cash Flow

The biggest advantage of multi-family units is the ability to generate multiple streams of income. Instead of relying on a single tenant, you can have several, reducing the risk of vacancies and improving your cash flow.

2. Economies of Scale

Multi-family units provide the benefit of economies of scale. Maintenance and operational costs, like property management, can be spread across several units, making them more cost-efficient than maintaining multiple single-family homes.

3. Faster Portfolio Growth

Multi-family properties allow you to scale your investments more quickly. Owning several units in one location enables faster accumulation of wealth without having to buy multiple properties

4. Tax Benefits

Multi-family properties often come with more tax benefits. For example, repair and maintenance costs, as well as property management fees, can be deductible, saving you money in the long run.

Which Should You Choose?

If you’re just starting out or prefer a simpler, more manageable investment, single-family homes might be the right choice for you. They offer stability, lower risks, and the potential for steady appreciation. However, if you’re looking for higher cash flow and the ability to scale your investment quickly, multi-family units could be your path to greater returns.