Selling a home is a big decision. But what if you still have an outstanding mortgage? While selling a home with a mortgage might feel complicated at first, With the right guidance, you can sell your property successfully and pay off your mortgage with ease.

Whether you’re upgrading, relocating, or downsizing, it’s absolutely possible to sell your home and navigate the process smoothly. Here’s how to sell a home with a mortgage, step by step.

Step 1: Know Your Mortgage Balance

The first thing you need to do is determine your mortgage balance. This is the amount you still owe to the lender, including any interest.

Contact your lender and request a mortgage payoff statement. Knowing your mortgage balance is crucial because it helps you understand how much equity you have in your home.

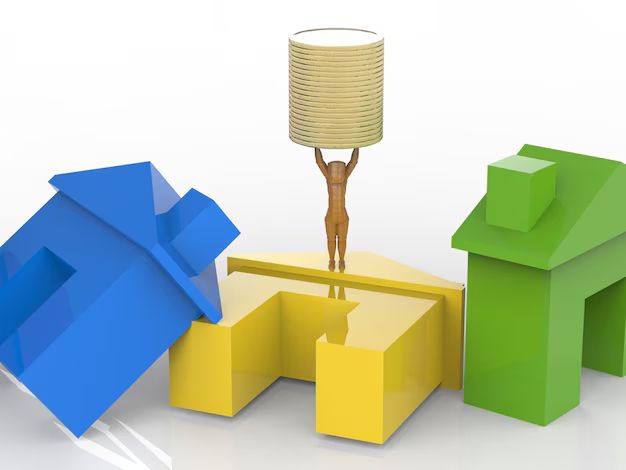

Step 2: Understand Your Equity

Equity is the difference between your home’s current market value and the remaining mortgage balance. If your home is worth more than what you owe, you’re in a great position with positive equity.

However, if you owe more than the market value of the home, you’re dealing with negative equity. That is where you negotiate a short sale with your lender.

This allows you to sell the home for less than the mortgage balance, and the lender may agree to forgive the remaining debt. Knowing whether you’re in positive equity or negative equity will help you plan your next steps and set a reasonable sale price.

Step 3: Get Your Home Ready for Sale

First impressions matter. The more attractive your home looks, the more likely you will sell quickly and at a higher sale price. This could be the key to ensuring that you cover your mortgage balance and even make a profit. Here’s how to prep:

Clean and Declutter

Repairs and Updates

Stage Your Home

Step 4: Work with a Real Estate Agent

Selling a home with an active mortgage can be complicated. That’s why it’s essential to work with an experienced real estate agent. A good agent will help you:

Price your home accurately, considering your mortgage balance and equity.

Market your home effectively to attract potential buyers.

Handle negotiations, paperwork, and communication with your lender.

They’ll also guide you through the mortgage payoff process and ensure the sale goes smoothly from start to finish.

Step 5: Close the Deal and Pay Off the Mortgage

Once you’ve accepted an offer, it’s time to close the deal. The buyer’s funds will first be used to pay off your mortgage balance.

If the sale price is higher than your mortgage, the remaining funds will be yours. However, if the sale price doesn’t cover the mortgage, you’ll need to settle the difference before closing. Once the mortgage is paid off, ownership transfers to the buyer, and your mortgage debt is behind you.