In real estate, investors are constantly looking for stable opportunities. While residential and commercial developments often take the spotlight, land banking has quietly become one of the safest and most strategic investment options.

With urban expansion, infrastructure projects, and population growth driving up land values, buying and holding land for future use or resale offers both security and impressive returns.

Understanding Land Banking

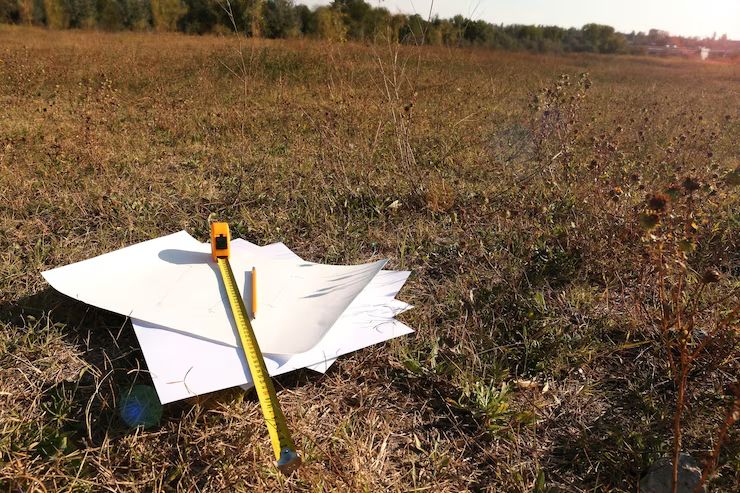

Land banking is the process of acquiring undeveloped land in strategically chosen areas and holding it over time with the expectation that its value will appreciate. Unlike other forms of real estate investment that require active management land banking requires passive management.

There are no tenants to manage, no structures to maintain, and fewer risks associated with market fluctuations in construction costs or rental demand.

Rising Land Values

The demand for land continues to grow, driven by urbanization, devolution, and infrastructural development. Counties like Machakos, Kajiado, Kiambu, Nakuru, and Laikipia have seen a surge in land prices over the past decade.

As Nairobi expands and satellite towns become more integrated into the urban economy, the land in these areas continues to appreciate significantly. Infrastructure projects such as the Standard Gauge Railway (SGR), Nairobi Expressway, and ongoing road networks have also opened up new zones of economic activity.

Investors who acquired land in these corridors before development began are now reaping massive returns. This trend shows no signs of slowing down, making land banking an investment approach to look forward to.

Minimal Risk and Low Maintenance

One of the key reasons land banking is considered safe is the low level of risk involved. Unlike buildings, land does not depreciate or require costly repairs.

There are no maintenance fees, property management costs, or vacancy concerns. Additionally, land is a finite resource. so, its value tends to grow over time, especially areas where it is demanded highly.

With proper due diligence land banking carries fewer complications than built properties. It is also highly liquid in certain regions, particularly those close to urban centers or transport hubs, where demand continues to grow.

Ideal for Long-Term Investment

Land banking is particularly suitable for long-term investors who are not looking for immediate cash flow but rather gradual and exponential value appreciation. Many investors have built generational wealth simply by buying land early and holding it.

For diaspora investors, it offers a secure entry into real estate with minimal management, while for local buyers, it serves as a hedge against inflation and currency fluctuations.